Israel, UAE close to reaching tax treaty

04/11/2021

A taxation treaty that would boost investment ties between Israel and the United Arab Emirates is in the works and could be finalized within the coming weeks.

The treaty is expected to help facilitate more than $2 billion in annual bilateral trade in the coming years and could grow to as much as $6.5b. a year within the coming decade. That would make the UAE one of Israel’s most significant trading partners.

Taxation treaties help ensure that individuals and corporations don’t pay the same taxes twice to different countries, and they help encourage bilateral trade. The basic terms of the Israel-UAE treaty have been agreed upon by both sides, and only a few questions of the scope of the agreement remain to be finalized.

However, regardless of when the treaty is actually signed and ratified by both countries, it would only come into effect next January 1.

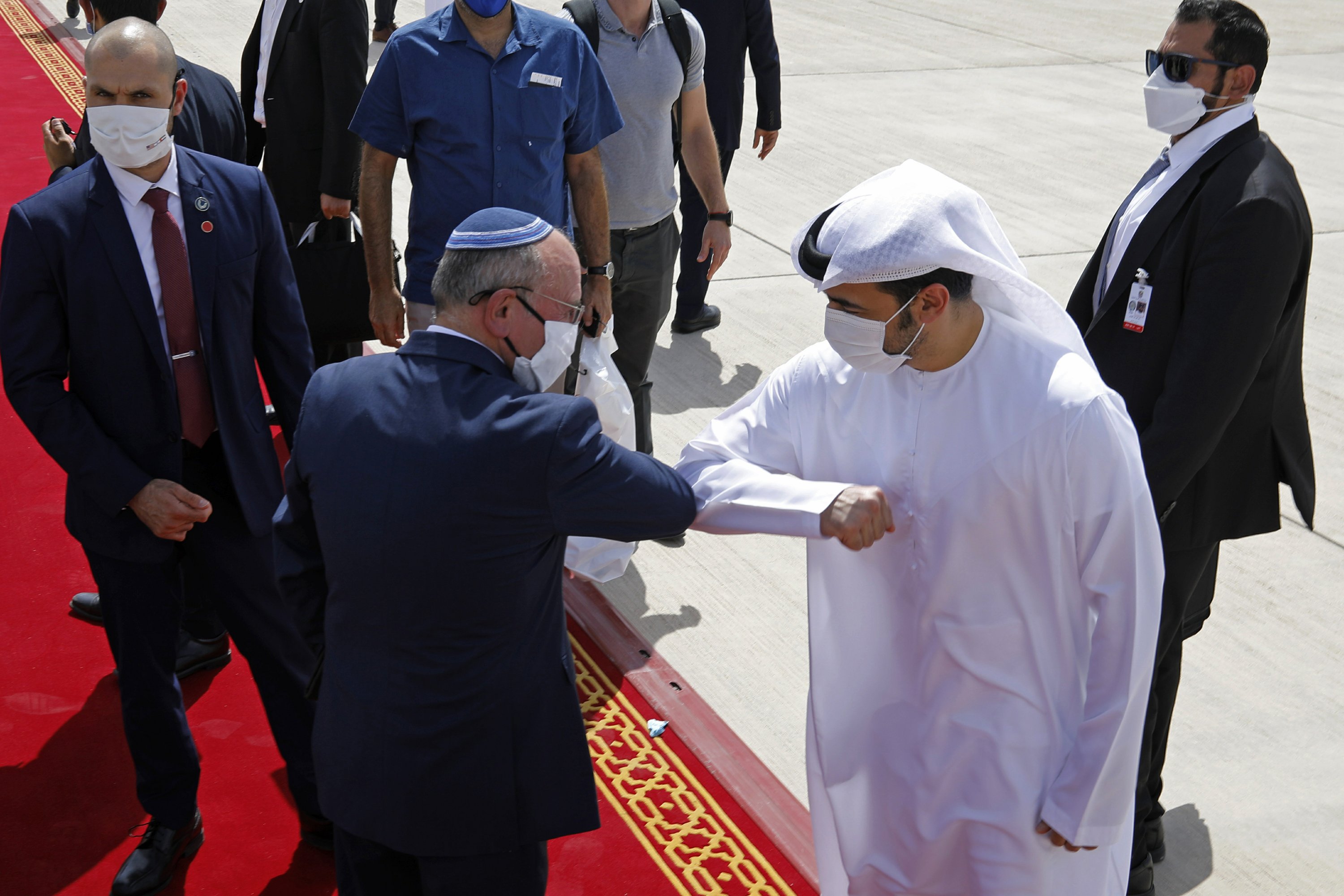

Since the two countries agreed to normalize relations in mid-August, the business and economic communities of Israel and the UAE have forged a number of collaborative efforts and partnerships to ease trade. While informal trade between the two nations existed before the Abraham Accords came into effect, even insiders have been surprised at how warmly economic ties have developed since the accords were formally signed last September.

Israel signed normalization agreements with several Arab countries last year, including Bahrain, Sudan and Morocco. The UAE is the only nation with which a tax treaty is currently being drafted.

Read More: Jerusalem Post